As an example, if you park in a garage as opposed to on the street, you might see a lower price as there's less of a chance your automobile will certainly be damaged or swiped. Exactly how far you drive from home to work belongs to the computation also. Long commutes indicate greater prices because you're spending even more time when driving.

In a group plan, this means the average age of your group can play a part in what you pay.

How To Calculate The Pre-tax Insurance On Your W2 for Beginners

Insurance suppliers use the variety of total cases and exactly how pricey those cases are to determine changes to your costs with time. When it's time to restore your plan, an insurer will assess your team's cases background and also readjust as necessary. If a couple of staff members had some clinical problems that brought about frequent or expensive brows through, that may be assessed your upgraded premium expense.

Your insurance provider may readjust your rates depending upon the general line of work of your employees. As an example, clerical team don't face the very same health dangers as manufacturing facility, construction, or offshore workers, so insurance policy premiums for a group of white-collar worker might be less than other occupations. The Kind of Protection as well as Desired Add-on Conveniences, Not all team health insurance coincide.

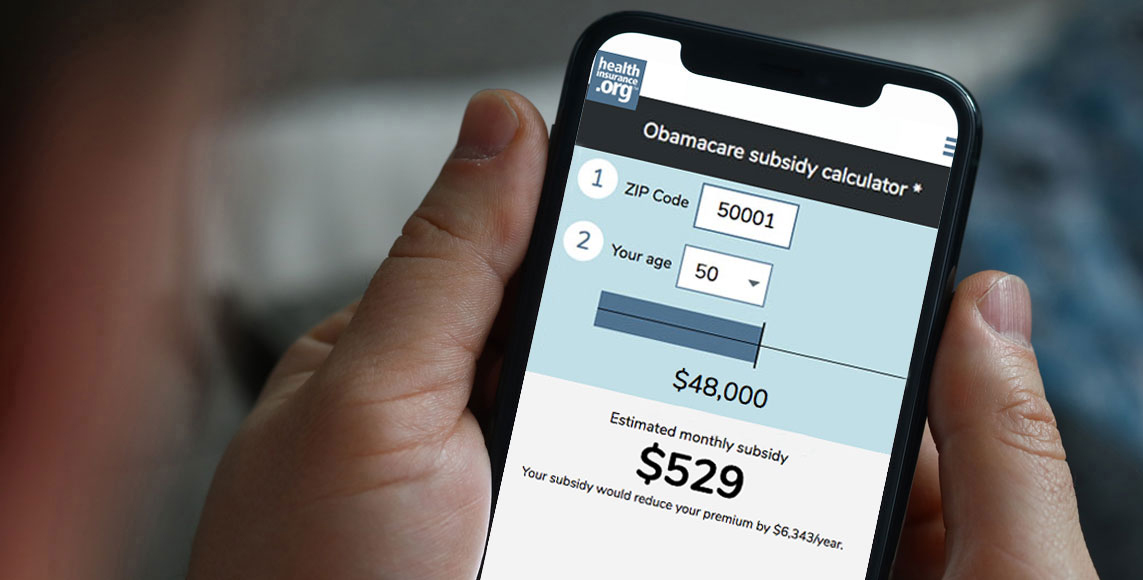

Five aspects can influence a strategy's regular monthly premium: location, age, cigarette usage, plan category, and whether the plan covers dependents. Your health, case history, or sex can't impact your premium. Exactly how costs are set Under the wellness care legislation, insurance policy business can make up just 5 points when establishing premiums.

Indicators on How Are Professional Liability Insurance Premiums Calculated? You Should Know

Where you live has a big effect on your premiums. Insurers can charge tobacco customers up to 50% more than those that don't utilize tobacco.

The classifications are based on how you and the strategy share costs. Bronze plans usually have reduced regular monthly costs and also higher out-of-pocket costs when you obtain treatment. Platinum strategies usually have the greatest premiums and also most affordable out-of-pocket prices. States can limit just how much these aspects impact costs. All Industry wellness plans cover the very same necessary health and wellness advantages.

A gained premium stands for costs made on the part of an insurance contract that has actually expired. Life and Wellness Insurers is still taking on a risk in order to generate the costs.

The Greatest Guide To How To Calculate The Pre-tax Insurance On Your W2

For this reason, insurance firms think about costs on an insurance policy agreement unearned till the agreement has run out. While the insurance company might have gathered a pre paid costs on the contract beginning date, the made costs is just the pro-rated amount of that costs up until the existing date.

In the event that the agreement is ended prematurely, the premiums would be returned to the insurance holder. For instance, think that a client purchased a 1 year auto insurance coverage policy as well as prepaid for six months of costs at $100 each month. Nevertheless, after one month, the auto numbers in a mishap, needing the insurance firm to reimburse the insurance holder.

Techniques for Computing Earned Premium, There are 2 primary techniques for computing the earned costs:1. Accounting approach, The bookkeeping technique takes the variety of days since the start of an insurance contract as well as multiplies the number by the costs gained each day. It is one of the most usual approach for determining made costs as well as properly shows the quantities insurance firms made on details agreements.

The smart Trick of In This Paper We Calculate Premiums Which Are Based On The ... That Nobody is Discussing

Direct exposure method, The exposure technique is a lot a lot more complicated and data-driven than the bookkeeping technique. It makes use of historic information to estimate the worth of insurance agreements. It considers the threat of payment and also the estimated collection of costs. Instance Making Use Of Accounting Approach, Think an insurance company composes an one-year automobile insurance coverage agreement with a premium of $100 monthly.