the amount of protection you need based upon business task If you have individual cars and truck insurance already as well as are unclear about whether you need commercial protection, an insurance representative ought to have the ability to assist you. Simply be prepared to explain just how you use the car for business and also exactly how usually, so the representative can precisely assess what you need for insurance coverage.

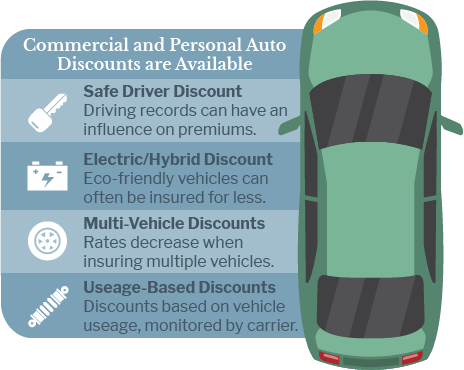

On the other hand, if your business is reduced danger, then you might pay well below the mean for commercial coverage. When contrasting prices for business automobile insurance policy, make certain to ask the insurer if there are any discount rates offered. For instance, if you're guaranteeing a fleet of 10 vehicles, the insurance provider may agree to reduce you a break on costs, which could assist in saving your organization money.

And also it may be much easier to have your policies in one place versus collaborating with several insurance providers when you're active taking care of daily organization procedures.

Protect employee-owned lorries with company automobile insurance If you have employees as well as they utilize their cars for business use, make sure they have adequate obligation protection with their personal automobile policies. As an example, if an employee drives his or her very own auto to make a financial institution deposit for business and also is in an accident with an additional motorist, his/her insurance coverage company will pay the claim as much as the plan restriction.

The 2-Minute Rule for Commercial Auto Insurance 101 - Thimble

A business car plan with an added non-owned vehicle liability endorsement could aid safeguard the company's properties from a pricey suit. Cover business proprietor's auto with a firm vehicle plan There are times when the organization owner's only car offers double-duty for both firm and individual usage. In these instances, a business vehicle plan is necessary.

It can include two kinds of physical damage protection for your insured lorries: Accident loss: damages from vehicle crashes. It also consists of 2 kinds of liability coverage: Physical injury protection: for accident-related injuries to others when you're at mistake.

It's required in many states for owned autos. Additionally, organizations that move goods or individuals throughout state lines are called for by federal legislation to have it. For larger industrial automobiles, you might need a commercial vehicle insurance policy. You require business vehicle insurance policy for automobiles that: Are used for service.

If you or a vehicle driver of your service car causes an accident that injures one more person or damages their residential property, they can submit a case on your plan as well as bring a legal action against you or the driver. Your obligation insurance coverage will certainly cover prices to pay damages on the insurance claim up to the policy limit.

Not known Facts About How Much Does Commercial Auto Insurance Cost? - Get Quotes

Your obligation insurance coverage will certainly additionally cover the costs to safeguard you or the chauffeur of your organization vehicle in an accident-related lawsuit, separate from the plan limit. What are the Coverages Included in a Business Car Insurance Policy?

If your cars are garaged out of state, talk to your representative to ensure you have sufficient insurance coverage for the states where your insured autos will be made use of. Is Personal Usage Covered by a Business Plan? Personal usage of a company car is normally covered by an industrial policy. Nevertheless, certain protection for member of the family is frequently not provided.

More Insights & Know-how Having trouble understanding your small company insurance coverage? Right here is a checklist of terms to assist. There are numerous aspects to take into consideration when operating your own service, including the importance of having residential property insurance. Here's what you require to know. Why are Umbrella insurance coverage so essential for local business? Below's what you ought to understand.

Find a local representative in your location:.

Explaining Commercial Auto Insurance - Direct Auto Insurance Can Be Fun For Anyone

Drivers under this group are usually referred to as liberal customers. An insured is also any person who is accountable for your conduct or the conduct of a liberal customer. Commonly called the omnibus condition, the wording affords coverage to any type of vehicle driver who may be held liable for an accident caused by a called insured or a liberal user.

This is essential to recognize, because companies are vicariously accountable for negligent acts of their staff members. If you are brought into a lawsuit resulting from an auto crash brought on by a negligent employee, the insurance claim must be covered. Adding drivers to your plan Detailing all workers that may be driving permits the insurance provider to analyze the threat and finance as they see fit.